Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

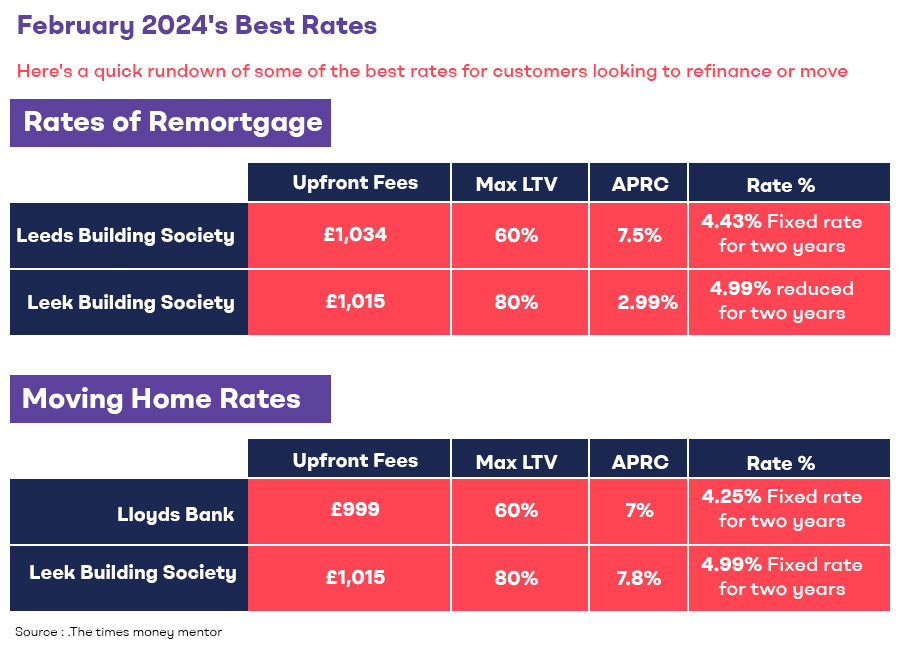

UK mortgage rates will alter in February 2024 owing to the Bank of England's efforts to fight rising inflation. From 0.1% in December 2021 to 5.25% today, the base rate has increased dramatically. This has influenced the housing market and raised mortgage rates, as expected. Consider the details of a new deal beyond prices before signing.

Learn about the home buying process in the UK.

High mortgage rates are expected for many borrowers in 2024, especially those leaving fixed-rate arrangements. The repayment amounts vary greatly because of the base rate's 15-year high. The average two-year fixed mortgage rate in January 2021 was 2.38%. Today, borrowing £250,000 for 25 years would cost over £435 more every month.

The average five-year fixed agreement rate rose from 2.94% in January 2019 to 5.18% this month, suggesting mortgage market evolution.

Despite market shifts, borrowers can take proactive steps to improve their chances of getting good offers.

Improve Your Credit Score: Lenders consider credit scores when deciding affordability. Checking your credit report, paying bills on time, and paying off debts will enhance your credit.

Explore Your Options: Compare mortgage rates from building societies, online lenders, and traditional banks using digital tools.

Speak with a Mortgage Specialist: Mortgage brokers may provide better terms and rates because of their larger lender network. Market knowledge might help them choose between fixed and variable rates.

Other factors: Despite the temptation to focus simply on rates, many factors affect the entire cost of a mortgage.

Consider Fees: Low-rate mortgages may have higher fees, raising the cost. For a complete assessment, review the fees.

Overpayments: Consider overpayments to cut interest rates. Check your lender's overpayment policy to avoid penalties.

Early Repayment Expenses: Paying off your mortgage early may incur expenses.

Rewards: Many lenders offer refunds or free services to attract customers. Compare advantages to costs and fees.

Since August, the base rate has been 5.25%, reflecting the ever-changing UK mortgage rate landscape. Potential homebuyers have been engaged, and mortgage-in-principle applications have increased, suggesting a strong desire to learn more about financing potential.

Read more about real estate due diligence to make more informed decisions.

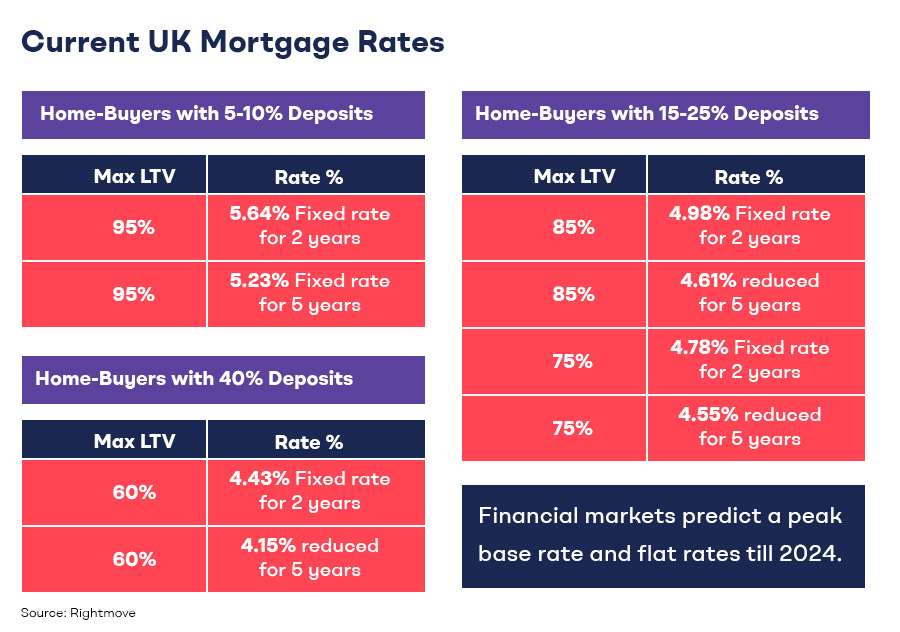

The average mortgage rate is continuously falling, which benefits those with smaller down payments. The average five-year fixed-rate mortgage rate is 4.66%, down from 4.67% last week. However, two-year fixed-rate mortgages climb from 4.98% to 4.99%.

In certain loan-to-value (LTV) brackets, typical fixed-term mortgage rates fluctuate little but significantly weekly.

The financial markets now expect the base rate to peak and stabilise until 2024, when it may fall. Although the exact period remains unknown, the coming months may see a decrease in the availability of fixed-rate mortgage packages.

Average first-time buyer property prices are £222,473, which may affect monthly payments. Monthly payments for a five-year fixed mortgage with an 85% loan-to-value (LTV) are £1,063, down from £1,086 a year ago.

Since the mortgage environment is continuously evolving, borrowers should stay informed, use mortgage calculators, and consider obtaining a mortgage in principle to better understand their borrowing capability. Before investing, it is advised to learn why interest-only loans are a better option.