Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

This article explores 2023 UK house prices' complexities. This is based on careful study of research and reports from the Office for National Statistics (ONS), the government website (gov.uk), and other trustworthy resources. We strive to provide a complete and informative review of the property market's dynamics this year to help you make informed decisions in this ever-changing industry.

From London's busy streets to the countryside's tranquility, house cost covers a range of diversity. To understand it better one would also need to focus on current economic situations, social impacts, government initiatives, and homeownership demand. This article will help you understand the conditions of UK property market so far in 2023 whether you're buying, selling, investing, or just staying informed.

Also read Real Estate Outlook London 2023.

Here are some key concepts that have a direct impact on UK property cost.

.jpg?1696330815991)

Supply and Demand: property prices rise when supply is lower than demand, and vice versa.

Inflation: Inflation in the UK can exert downward pressure on real estate cost in the short term as it reduces the number of buyers in the market caused by lower disposable income. .

Economic Growth: Rising incomes increase property demand and cost, whereas recessions diminish affordability and demand.

Interest Rates: High interest rates raise mortgage costs, lowering property demand, while low rates encourage homeownership.

Consumer Confidence: Positive market expectations stimulate homebuying, while price-fall fears hinder it.

Unemployment: Rising unemployment affects affordability and deters homebuyers.

Mortgage Access: Tighter lending standards limit affordability, but easier mortgage access boosts demand.

Affordability: As property cost grow relative to income, affordability declines, affecting demand.

Geographical Factors: High demand and limited supply can raise cost in desirable locations even when national trends diverge.

Global Events: Global events can influence real estate cost through factors like economic stability, investor sentiment, and demand for property from international buyers.

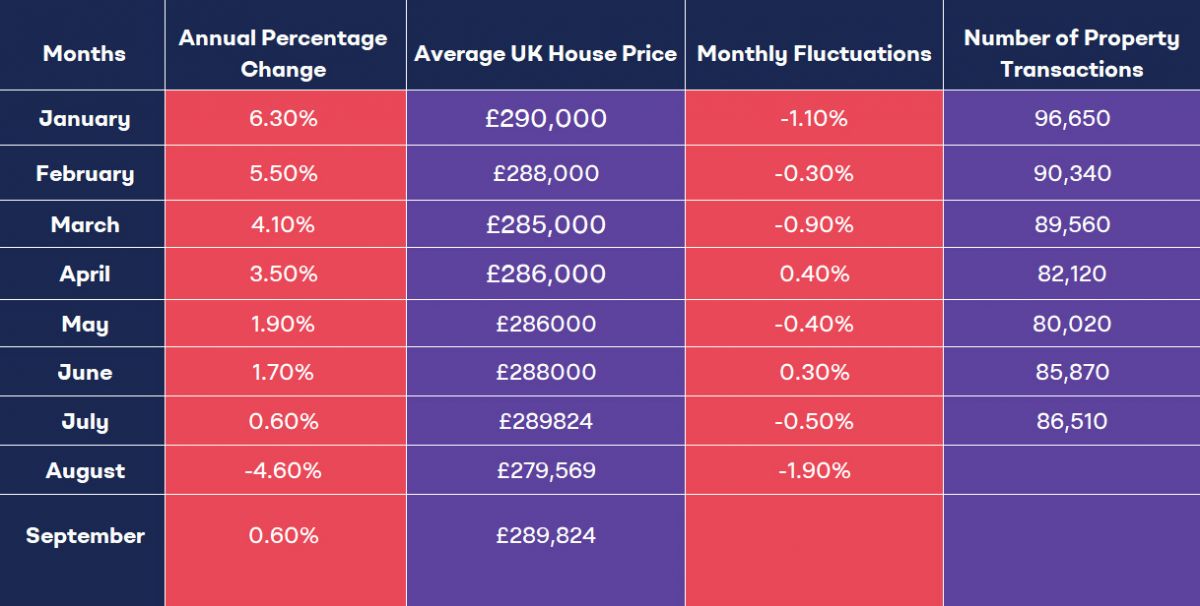

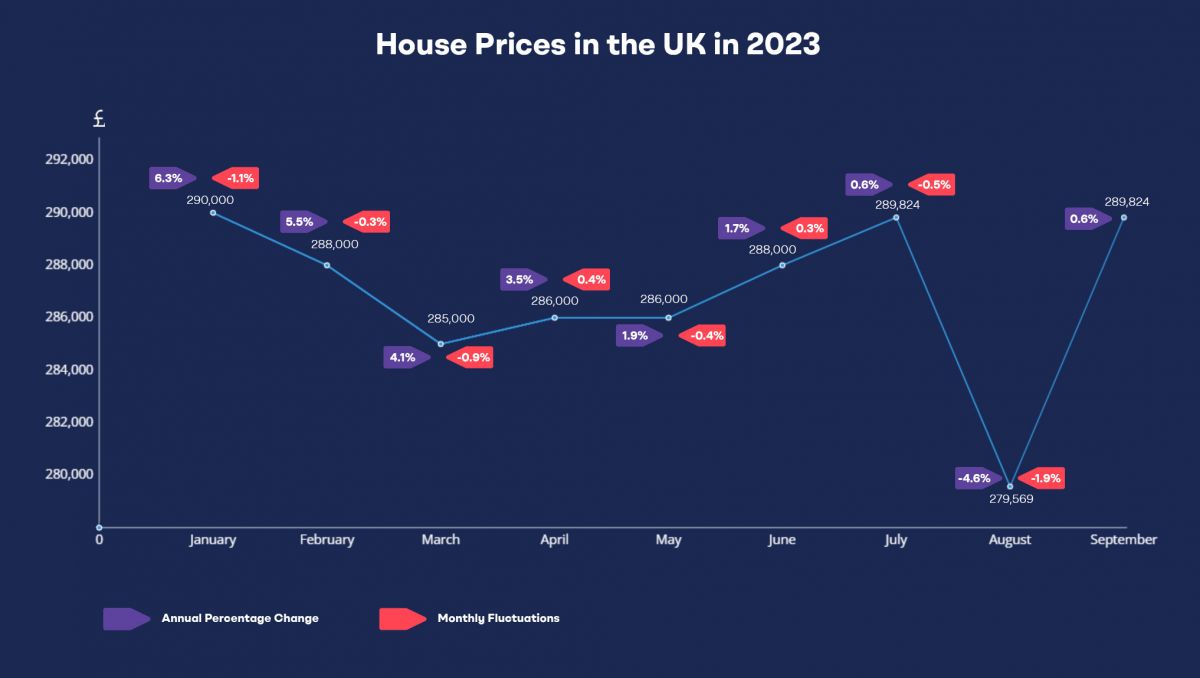

Let us now see how real estate cost have moved in 2023 and how they have impacted the overall property market in the region until September this year.

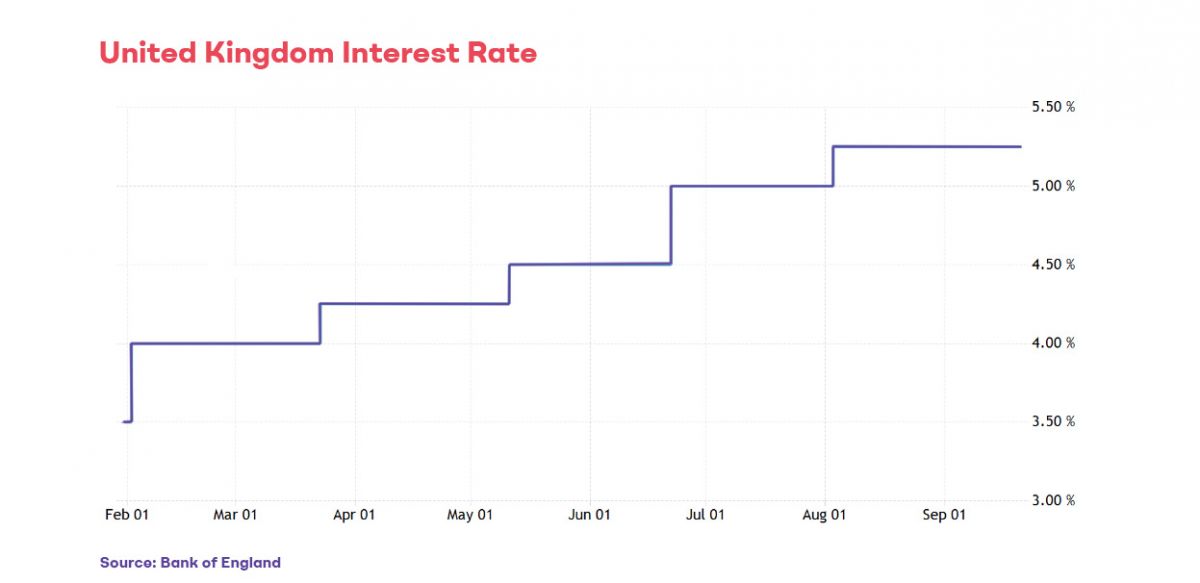

Depending on how inflation numbers settle later this year, the BOE may decide to hike rates again. It’s not unreasonable to anticipate more declines in property values this year in light of these challenges that homeowners face including rising mortgage costs and higher cost of living. This corrective cycle may last through 2024.

Here is a visual representation of the trends in the real estate cost in the United Kingdom from January to September 2023.

Impact of Borrowing Costs: Robert Gardner, Nationwide's chief economist, attributes the slowdown in house price growth to rising borrowing costs. High borrowing costs have reduced property market activity, with mortgage approvals 20% below the 2019 average in recent months.

Housing Market Activity: Lower mortgage approvals and more weak mortgage application data indicate reduced property market activity. These factors suggest a market well below pre-pandemic levels.

In September, 2023, various factors came to light that have impacted the real estate prices drastically, vis-à-vis;

House price growth varies by region. North East England had the highest annual percentage change in house prices, 2.7%, with an average price of £167,000. The South West saw 1.0% price drops, averaging £323,713. London, with its high average house prices (£534,265),saw a 1.1% annual house price growth decline.

Despite ongoing challenges, estate agents report continued sales, albeit slowly. Cash buyers are less affected by higher interest rates and are still determined to find suitable properties. Some house hunters have changed their budgets or search criteria, and sellers are more flexible on price.

Record-high rental costs are encouraging more tenants to become homeowners. Rents rose 12% annually, the highest increase since 2014. Thus, first-time buyer sales have remained steady, outperforming other property market segments.

Despite a slight increase in new listings in September, sales have been slow across all property types. August was slower than usual due to 14 consecutive Bank of England interest rate hikes and pandemic-related market restrictions. Local expertise is needed for successful transactions due to regional market conditions.

The Bank's decisions heavily impact mortgage rates and property market activity. By the beginning of 2024, the market is still expecting an increase in the BOE base rate to 5.5 percent.

Following the latest inflation and labour data, which suggested that previous policy tightening may be taking effect, the Bank of England held its policy interest rate at 5.25% on September 21, keeping borrowing costs at their highest level since 2008. It was the first policy tightening halt in nearly two years after the central bank's 515 bps hikes. The Monetary Policy Committee voted 5-4 to maintain rates, with four members supporting a 25-bps hike. The central bank also predicted a sharp drop in CPI inflation due to lower energy inflation, despite increased oil price pressure, and lower food and core goods price inflation. Policymakers have pledged to tighten policy if required.

While the Bank of England's decision to halt interest rate hikes in September 2023 may provide some respite for potential homebuyers, it does not fully alleviate the ongoing challenges of high house prices and limited affordability. The property market in the UK remains closely tied to the central bank's policy decisions, and any future changes will continue to influence the trajectory of house prices in the coming months.

England's property problem is worsening, with more households living in temporary property than ever before in the first quarter of 2023. Official statistics show that roughly 105,000 households live in hostels or shared property, up 10% from last year.

In the first quarter of 2023, 20% more homeless households, particularly families with children, needed property than in 2022.

Nearly 38,000 households are at risk of homelessness, a rate that has held steady since early 2022. Common reasons include landlords selling or reletting houses and tenants having trouble paying rent due to financial issues.

The UK faces a housing shortage, with average house prices reaching a record of £292,555 ($378,015) in September 2022. Prices have fluctuated, but rising mortgage rates have kept them high.

The situation has worsened due to rising rents and rising demand because many people cannot afford homes.

Housing expenses and food and energy prices are driving greater financial strain on UK households. UK consumer price inflation was 7.9% in June 2023, the highest among the Group of Seven.

To meet housing demand, Crisis, the National Housing Federation, and Heriot-Watt University researchers estimate that 380,000 homes must be built annually in England, Scotland, and Wales. However, the National House Building Council recorded only 192,000 UK home builds in the preceding year.

The UK government wants 1 million additional dwellings in England by January 2025. The housing crisis is difficult. And, thus, this brings a huge opportunity for the investors towards the housing market in the United Kingdom.

The UK housing scarcity, especially in 2023, will undoubtedly raise house prices. Limited housing supply and high demand can boost buyer competitiveness and property prices. Thus, the already high cost of property in the UK may climb higher, making it harder for aspiring homeowners and renters to afford.

House prices are expected to continue facing downward pressure throughout the rest of the year and into the next.

Despite this, it's essential to remember that prices remain significantly higher than pre-pandemic levels, with a £40,000 (+17%) increase observed.

The market is likely to find an equilibrium where buyers are comfortable with higher mortgage costs than those seen in the previous 15 years.

Due to factors like rising mortgage rates and regional variations, the UK housing market's price growth has slowed down in 2023. While the market has shown monthly fluctuations, first-time buyers have found increased affordability. The road ahead includes ongoing adjustments as the market strives for equilibrium. Monitoring economic conditions and consumer sentiment will be crucial in the months ahead.