Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

Buy-To-Let property investments are among the most important drivers in the real estate industry. The asset market's private rental sector has been rising in recent years, as demand for letting properties has skyrocketed. This is gaining appeal among investors seeking medium- to long-term investments. Despite the economic shock caused by the pandemic, the UK economy has recovered spectacularly, with the asset market shattering records last year.

In 2023, the BTL sector managed to exceed previous benchmarks significantly according to USwitch:

Here are the top ten reasons to invest in BTL real estate investments while the market is primed for an uptick.

There is a considerable shortage of letting stock, which has resulted in a significant increase in letting prices in recent years. Tenant demand has risen and the lack of available properties has spurred competition among tenants for newly available lets. The average online search for real estate produces four times more real estate for sale than real estate for rent. With the supply situation showing no indications of improvement, rents will keep rising, benefiting landlords greatly. The pandemic played a significant role in this situation, since a lack of materials delayed several housing projects around the country.

Current tenants in letting properties are leaning towards extending their lease with their current landlord in order to avoid the premium prices that are now associated to properties due to economic circumstances. New tenants, on the other hand, are looking to migrate to regions with cheaper monthly letting prices than, say, London. There is a lot of potential for attractive returns as an investor if you can capitalise on locations with increasing letting demand.

Here are the top ten areas of the UK letting sector currently:

.png?1678806144225)

Source: Top 10 Buy-To-Let areas in the UK - Simply Business

The UK population has been on a growing trend since the 1950s. According to Worldometer, the current population of the United Kingdom is 68,853,465. This represents an almost 1 million increase over the recorded population in 2020 of 67,886,011. Another cause for the housing shortage that is driving up letting demand is this. Those coming to the UK for employment or education are an important source of population expansion that investors can target. These two groups of people will be actively looking for a letting real estate for the period of their assignment and maybe a permanent stay afterward.

With the amount of houses being built right now at its lowest point in decades, investors can capitalise on the promise of reintroducing housing stock into the market. Hundreds of unoccupied houses can be found around the United Kingdom. These vacant homes will help supply the demand for letting real estate as long as investors can acquire them and make them available to tenants.

With Buy-To-Let investments, you could instantly start generating income if you invest in a real estate that is already tenanted or with tenants looking to extend their contract under the new landlord rather than seek a different residence. Due to the exceptionally strong demand for letting properties at the moment, it will not be difficult to find new tenants for houses that are not already occupied. Income can vary based on the number of tenants in the home and the area's letting yields, but you could earn returns of up to 12-15% if the rental yield you're looking for is between 6-8%.

At Novyy the properties we offer are made sure to be fully tenanted before being available to investors. Our initial yields begin at 13%+ as well, making income generation with us easier than ever before. Visit our product page or watch our video to learn more about our investment structure in detail.

Fixed rates are beginning to fall substantially because of competition among mortgage lenders eager to attract business. According to What Mortgage, variable mortgage rates are also 1% less expensive than fixed mortgage rates. Profit can be generated with either fixed or variable rates; but, variable rates are currently considered to be significantly beneficial to profit should the base rate move in line with expectations over the next few years.

Mortgage rates are currently ranging from 4-7%, with most five-year fixed mortgage rates hovering around 4%, however these are being phased out of the market due to the unusually high volume of business affecting lender services. This is a first come, first served situation while these rates are available, thus it is ideal for an investor to capitalise on cheap rates like this as it will help maximise profits in the near future.

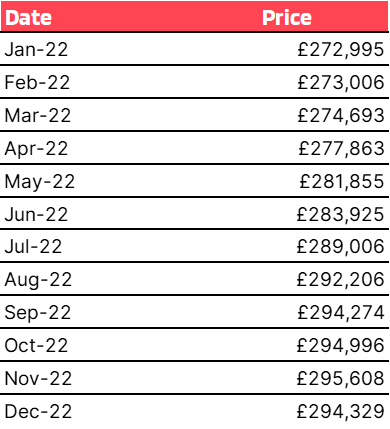

In a BTL investment, timing is everything. Many individuals say they are waiting for specific events to occur, such as a housing price crash or the perfect moment to buy an asset based on their analysis, but the reality is that buying as soon as possible is the smartest decision, as real estate and rents continue to climb year after year. Many investors who have the mindset of waiting for the appropriate time may lose out entirely or miss out on significant earnings as a result of their hesitancy. House prices increased by more over £20,000 in 2022 alone, from January to December.

Source: UK House Price Index – Land Registry

This table shows that house prices rise dramatically between May and August. The optimum time to buy is between January and April. Time is crucial, and once an investor understands when to buy a real estate, they may maximise revenue from rent and real estate appreciation for the following years.

Property investment will always be a solid financial strategy. The BTL market will expand as more job opportunities become accessible and the population grows. Regardless of the volatile political circumstances and economic instability that have plagued the likes of stocks and cryptocurrency, property will always be safe because the physical entity of a house will never lose value due to its necessity and importance in life. While property prices and rents fluctuate throughout the year, traditionally, rentals and house prices in the UK have only risen.

The great recession of 2008 was the one outlier that triggered a market crash. Many investors, however, viewed this as an opportunity to invest in properties at low prices that may never be seen again, and they are now reaping the rewards as house prices and rentals have skyrocketed in the nearly two decades afterwards. Property prices fell 21% during the housing crisis until Spring 2009. If you have the patience and financial security to weather economic downturns, the uptick can be quite lucrative as an investor.

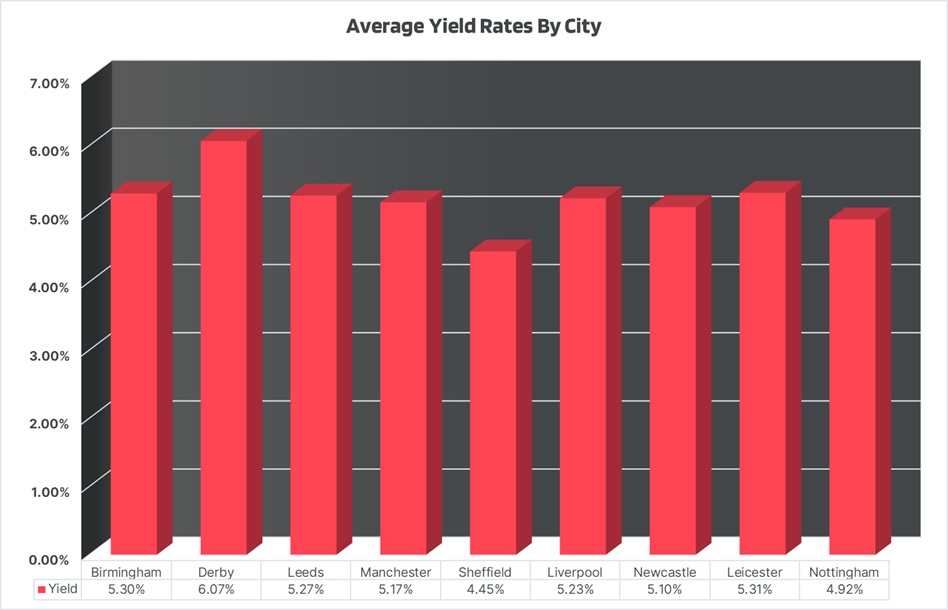

The most appealing aspect of investing in BTL property is the potential income. This is determined by the rental income you receive from tenants as well as the average yield in the area where you acquire the property. These average yields vary according on a region's economic situation. In the long run, yield can be quite profitable, with some postcode regions seeing up to a 15% rental yield.

Currently, the best average rental yields range from 5 to 6%. According to Joseph Mews, Derby now has the highest average rental yield in the UK at 6.07%. Birmingham's postcode B7 has the highest rental yield of any postcode area at 10.87%. These places have one thing in common: they are both in the West Midlands or the North West. Many areas in that region have comparable average rental yields, with one or two postcode areas having a relatively high yield rate.

Investing into a property in these areas can be substantially beneficial to an investor as they can gain an abnormally high rental income from the yield rates.

Source: Best Places To Invest In UK Property 2023 – Joseph Mews

As an investor and landlord, you must have a target tenant audience to assure rental income. This can vary based on the location; for example, Coventry has a large student population, therefore the majority of tenants may be university students, as opposed to Milton Keynes, which is a leader in the tech industry and has many job opportunities in technology industries. Which type of property will be suited for each type of tenant is a question investors must ask themselves and answer in order to maximise the return on their investment.

Large houses near universities or colleges can be converted into HMOs which increases the potential monthly rental income due to the increased number of occupants.

All investors ultimately want to generate an income that will free them from having to work a 9 to 5 job every day for the rest of their lives and enable them to retire earlier. A single BTL investment can give an investor a lot of flexibility with their employment position, allowing them to significantly reduce their hours. An investor with multiple options may be able to quit their employment and live solely on rental income.

All of this depends on the tenancy circumstances, as tenants may vacate if their lease expires or if they are unable to pay their rent. Choosing the correct tenants is crucial for the overall duration of your potential trental income and financial freedom as an investor. Never judge a book by its cover or a tenant by what they say on the surface, so conduct a credit check, confirm employment status, salary, and ID, and, if possible, seek a couple of references from previous landlords.

10. Diversification

BTL investments are not linear; there are numerous ways to amass assets in the buy-to-let market. A fractional investment approach allows an investor to purchase shares of a buy-to-let property. They are advantageous to investors who do not wish to deal with the day-to-day management and upkeep of properties, allowing them to continue with their own activities while holding a portion of the property as a shareholder. Depending on the size of their share, they will still earn a portion of the rental income from the property.

Purpose-built student accommodation (PBSA) is a buy-to-let investment strategy focused only at students. The idea is to pick successful student markets and capitalise on the highly consistent rental demand year after year because of the influx of students for the upcoming academic year. Diversifying an investor's portfolio with various types of buy-to-let strategies provides an indicator of the top performer in the present market and where they should focus their efforts for future investments.