Over the past five years,

student housing investment has grown significantly, attracting the attention of numerous foreign investors. In context, the Global Student Housing Market was valued at USD 11 billion in 2021 and is projected to reach USD 147 billion by 2027, expanding at a CAGR of 4.95% over the forecast period.

According to research conducted by property developer and PBSA specialist Stripe Property Group &

mpamag, the purpose-built student accommodation (PBSA) market is currently valued at approximately £4 billion and is expected to increase to £4.5 billion by 2025. Moreover, the group added that the impact of the pandemic had erased with the PBSA sector's market size predicted to reach £4.2 billion in 2023, a 6% annual increase and 2% above its pre-pandemic apex. The group then also predicts that PBSA momentum will continue to develop, increasing by 8.1% by 2025.

The reports from these well-known chains outline the substantial development of student housing investments over the next few years. Now, let's examine student housing and how advantageous it is for investors in the present day.

What is Student Housing Investment?

- The Higher Education Statistics Agency (HESA) reports that there are presently 679,970 international students pursuing degrees in the United Kingdom.

- UK's international student number increased 12.3% from 2020/2021, reaching 605,130, a 12.3% increase from the previous year's statistics.

Definition of Student Housing Investment

Student property investment entails investing in real estate properties designed to facilitate students, which are frequently located in proximity to universities and colleges. These residences provide students with suitable living quarters during their academic years. Consistently high demand for student accommodation is driven by the rising number of students pursuing higher education.

Student property investments offer numerous benefits, including a stable rental income stream, higher rental yields than traditional residential properties, and favorable rental terms, such as extended tenancy agreements. Investors value the passive nature of

student property investments, which can be managed by specialized student housing management firms.

However, market dynamics and location play a significant role in determining the success of these investments, and factors such as proximity to educational institutions, local amenities, and transportation connections should be evaluated with care. Investors interested in entering the higher education market will find student property investment to be an enticing opportunity.

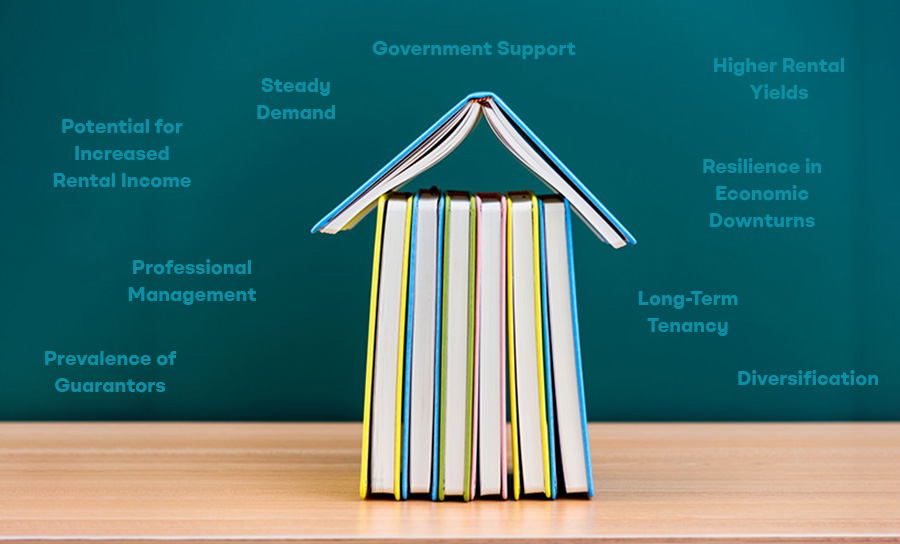

Key Aspects of Student Housing Investments

Investing in student property is a golden ticket to lucrative returns, as the demand for quality accommodation continues to soar. Here are a few advantages to explain the context more precisely.

Steady Demand

The increasing number of students pursuing higher education in the United Kingdom has resulted in a consistent demand for student housing.

Higher Rental Yields

Long-Term Tenancy

Students frequently rent housing for the duration of their course, allowing landlords to enter into long-term tenancy contracts.

Prevalence of Guarantors

Numerous student housing contracts include parental guarantors, which reduces the risk of rental arrears and enhances the security for landlords.

Lower Vacancy Rates

Typically, the high demand for student housing results in lower vacancy rates and a reduced risk of rental income loss.

Potential for Increased Rental Income

Prime student housing locations often experience rental growth, offering investors the possibility of increased rental income over time.

Diversification

Investing in student housing provides diversification benefits because student housing is a distinct asset class within the real estate market, thereby reducing exposure to fluctuations in other sectors.

Professional Management

Government Support

The government of the United Kingdom has introduced numerous initiatives and policies to support the development and enhancement of student housing, thereby creating an investment-friendly environment.

Resilience in Economic Downturns

Student accommodation has demonstrated resiliency during economic downturns, as education continues to be an essential sector despite challenging economic conditions.

What Considerations Should Be Made Before Investing in Student Housing?

Before diving headfirst into the exciting world of student property investment, it's essential to consider a few key factors. Location, demand, local universities, rental yields, and market trends play a crucial role. So, put on your thinking cap and let's explore the ABCs of investing in British student property.

Understanding the University Opportunity

Focus on the university's stability, consistent enrollment, and historical economic cycles when evaluating student housing. This is the true value of student accommodation because it capitalizes on the institution's historical stability as an investment vehicle. Student housing is less aligned with traditional real estate portfolios because it is not substantially affected by external forces.

Understand the Property

The second step is to examine the property itself. What was the property's performance throughout the Great Recession? Could they increase the rent? Were they able to maintain occupancy? Essentially, were they able to maintain stability during trying times?

Evaluating Competition

You must also assess the competitive set. You should evaluate the past performance of the top four or five competitors in the region over the past several years. Believe it or not, you must ensure that the properties with which you are competing are also thriving. You do not want to be in a market where your competitors are offering concessions or reductions, as this indicates an economic downturn. If they are leasing faster, that increases demand for your property.

Analyzing the Location

Universities with centuries of history frequently have developed land, making it a valuable asset to discover well-located properties within walking distance. These locations are challenging for rivals to imitate or alter.

Analysis on Student Housing Market

Understanding the target market is essential for student housing investment. Identifying the expanding or new student population aids in determining the optimal amenities and activities, as well as the most expensive student demographic.

Evaluating the Cap Rate

The cap rate is an essential instrument in commercial real estate for assessing the growth potential and income security of a property. It is calculated by dividing net operating income by the sales price of the property, resulting in higher sales prices if net operating income increases.

Understand Expenses

Student accommodation is inexpensive due to its proximity to major universities, which frequently provide amenities such as union centres, pools, and fitness centres. This income-generating property generates a favourable expense ratio, assuring positive cash flow, thereby making the property more secure and stable.

In Summary

So, what are the reasons for Investors to prefer Student Housing Investments in 2023?

The student housing sector presents a lucrative global market that presents promising prospects for cross-border investment and portfolio diversification. Based on the analysis conducted by

Knight Frank, it has been observed that the United Kingdom, Germany, France, Spain, and the Netherlands collectively represented a significant 80% share of the overall investment volume in Europe during the year 2022. However, it is worth noting that additional markets such as Italy, Poland, Portugal, and Ireland are progressively emerging as appealing destinations for potential investments.

The student housing industry is a

dynamic and flexible sector that effectively caters to evolving student preferences and requirements. Student housing providers are now presenting an array of enticing options to cater to the evolving needs of students. These options include flexible lease agreements, innovative hybrid models that seamlessly blend online and offline learning experiences, state-of-the-art co-living and co-working spaces, wellness and sustainability amenities, as well as engaging social and community events.

The student housing industry is a robust and reliable sector that exhibits remarkable resilience in the face of economic shocks and crises. During the unprecedented Covid-19 pandemic, it is noteworthy to highlight that student housing occupancy rates have consistently maintained a commendable level throughout the

European region. This can be attributed to the discerning choice of students who highly prioritize the paramount aspects of security, convenience, and superior quality that purpose-built accommodations offer. Furthermore, it is worth noting that student housing rents experienced a commendable growth of 2.4% on average throughout the European region in the year 2022. This notable performance has surpassed the growth rate observed in other residential sectors.

Increasingly in recent times, landlords find the student housing more profitable in terms of

buy-to-let investments due to its rising rental yields and less complexities. The increase in student populations and accessibility to education on a global scale has led to an increase in demand for student housing. Novyy, a game-changer in innovative Prop-Tech Solutions, offers a student housing-specific, streamlined options on its platform. Using technology and data-driven insights, Novyy streamlines operations, improves tenant management, and optimizes returns.