Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

Amidst the turbulent landscape of global finance, real estate private equity investment stands as a beacon of both challenge and opportunity in 2024. As we navigate through the aftermath of a tumultuous year characterized by economic uncertainty, geopolitical tensions, and market dislocation, the resilience of real estate as an investment class comes into sharp focus. In this dynamic environment, investors are poised to capitalize on emerging trends, innovative concepts, and insightful news shaping the future of private equity investment in the real estate sector. Join us as we delve into the trends, concepts, insights, and news defining real estate private equity investment in 2024.

Real estate private equity (PE) stands as a sophisticated investment avenue where firms mobilize capital from external investors to strategically acquire, develop, operate, and enhance properties, ultimately aiming for lucrative returns. Private equity entities predominantly target commercial real estate assets, encompassing offices, industrial spaces, retail properties, multifamily complexes, and specialized assets like hotels. Notably, the investors in such ventures include pension funds, endowments, insurance companies, family offices, and affluent individuals, collectively known as Limited Partners (LPs). Often, this investment approach focuses on maximizing asset value through proactive management and strategic initiatives, resulting in favourable exit opportunities.

Amidst a backdrop of continued macroeconomic uncertainty and market dislocation, real estate private equity (PE) investment in 2024 remains dynamic and evolving. As participants in the private market navigate through challenges and opportunities, key trends emerge, shaping the landscape of real estate private equity.

Macro Uncertainty Impact: Despite macroeconomic challenges, real estate private equity (PE) investment remains active in 2024, albeit with cautious optimism.

Asset Scrutiny: Investors are meticulously assessing assets amidst reduced deal volumes, emphasizing thorough due diligence and strategic alignment.

Value Creation Strategies: The focus on value creation persists through strategic commitment, structural flexibility, and thematic investments in sectors like senior living and purpose-built student accommodation (PBSA).

Regulatory Reforms: Regulatory changes, such as transparency improvements in land ownership and biodiversity net gain requirements for developments, shape investment strategies.

Opportunistic Investments: Opportunities arise in distressed assets and forced sales, with investors leveraging hybrid debt and equity structures to capitalize on market dislocations.

Sustainability Integration: Increasing awareness of climate risk drives demand for sustainability, leading to the adoption of green leasing practices and responsible building management among real estate PE investors.

Investing in private real estate offers potential for significant returns, but it's crucial to acknowledge and mitigate the inherent risks. Here's a breakdown of common risks associated with private real estate investing:

Read more about CRE market challenges here.

Amidst shifting economic landscapes, private equity (PE) investment in real estate continues to navigate through a dynamic environment. As 2024 unfolds, a blend of tailwinds and headwinds shapes the trajectory of investment activity, presenting opportunities and challenges for industry stakeholders. Let's delve into the nuanced dynamics driving the real estate private equity landscape this year.

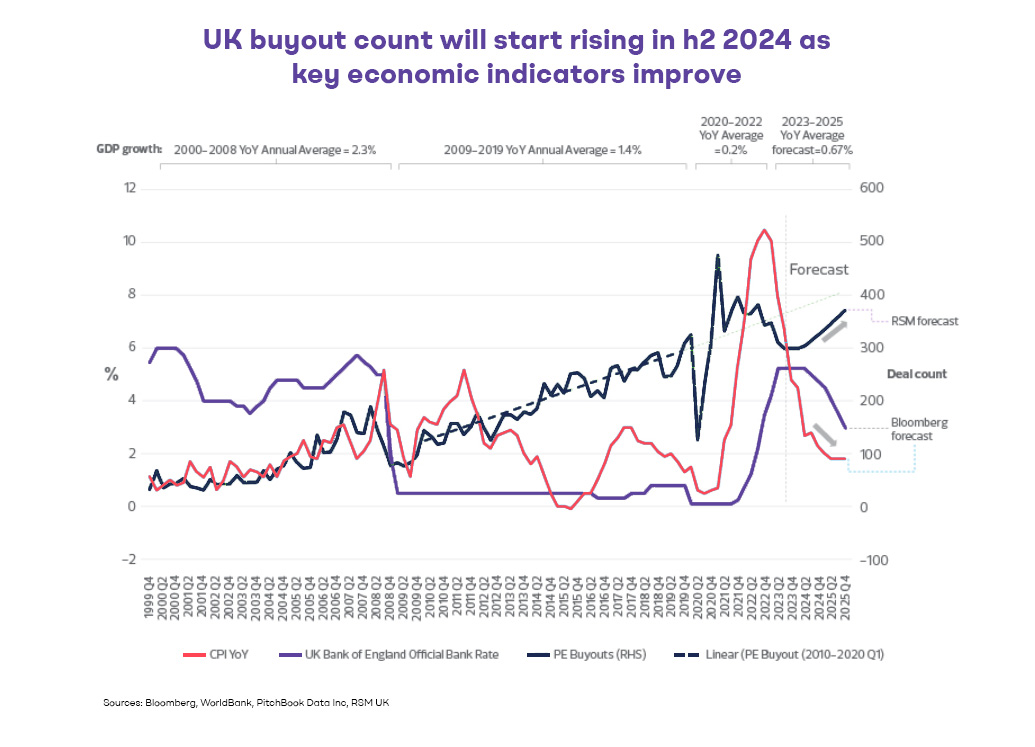

The UK buyout count will start rising in the first half of 2024 as key economic indicators improve. In the realm of real estate private equity, the forecast for 2024 entails a transition marked by evolving economic indicators and shifting market sentiments. Key economic indicators, especially in the latter half of the year, are showing signs of improvement, indicating an upward trajectory for the UK buyout count. This shift underscores the pivotal role of economic factors in shaping investment patterns within the private market.

A convergence of macro-economic factors fuels the resurgence of momentum in PE deal activity, catalysing investment initiatives and unleashing unmet demand within the market. Notably, the moderation of inflation and stabilizing interest rates instil confidence among investors, fostering a conducive environment for transactional activity. Moreover, the substantial pool of dry powder underscores the readiness of PE firms to capitalize on emerging investment opportunities, particularly in the middle market segment.

The accumulated deal flow resulting from a shift in portfolio dynamics amplifies the prospects for investment activity, with a plethora of UK-based PE-backed companies poised for potential exits in the near term. This influx of deal flow presents a compelling landscape for investors seeking strategic acquisitions and value-enhancement opportunities within the real estate sphere.

Despite the optimism surrounding investment prospects, certain headwinds persist, tempering the pace of transactional activity within the real estate private equity domain. Lingering concerns over inflationary pressures and subdued economic growth underscore the challenges facing investors, influencing their risk appetite and investment decisions.

The projected trajectory of the UK buyout count in 2024 reflects the interplay of economic factors and market dynamics, indicating a gradual uptick in investment activity as the year unfolds.

Amidst the dynamic landscape of the UK's real estate market, the first quarter of 2024 witnessed notable private equity activity, as highlighted by a series of significant transactions facilitated by investment banks. These deals underscore the strategic focus of investors on specific asset classes and reflect their confidence in the long-term potential of the UK market.

Partnering with Goldman Sachs, Singapore's sovereign wealth fund, GIC, invested £300 million in purpose-built student housing portfolios across prime UK university locations. This investment underscores the growing appeal of student housing assets in major educational hubs.

Engaging DC Advisory, a UK-based Real Estate Investment Trust (REIT), restructured its central London office portfolio, emphasizing the sale of underperforming assets and reinvestment in modern workspace features. This reflects ongoing adjustments within the office sector to accommodate hybrid work models.

A boutique investment banking firm facilitated £250 million in financing for a new life sciences research facility in London, highlighting growing investor interest in life sciences properties driven by biotechnology and pharmaceutical advancements

Led by a Canadian pension fund and a European investment management firm, an international consortium committed £400 million to a large-scale build-to-rent development project in London. This highlights the increasing popularity of the build-to-rent model in meeting the demand for professionally managed rental housing.

The landscape of real estate private equity investment in 2024 is characterized by a blend of resilience, innovation, and strategic adaptation. As investors navigate through macroeconomic uncertainties and market dynamics, they are poised to capitalize on emerging trends, forge strategic partnerships, and leverage innovative concepts to unlock value in the real estate sector. From the resurgence of momentum driven by favourable economic indicators to the strategic focus on specific asset classes such as logistics, student housing, and life sciences, the trajectory of real estate private equity investment in 2024 reflects a dynamic and evolving landscape. With a keen eye on insights, trends, and news shaping the industry, investors are well-positioned to navigate through challenges and seize opportunities, contributing to the continued growth and evolution of the real estate private equity market in the years ahead.