Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

Due diligence is a crucial step that should never be neglected when making real estate investment decisions. Making informed decisions and reducing potential risks require rigorous due diligence, whether you're an experienced investor or a first-time buyer. Before finalising a transaction, due diligence involves thorough research and analysis of a property's legal, financial, and physical features. Through proper due diligence in your real estate investments, you could be a successful real estate investor. In order to help you confidently negotiate the complex world of real estate acquisitions, let us find some of the key components of real estate due diligence. First, let's understand what due diligence is.

Buyers, investors, or developers carry out due diligence to assess the suitability and viability of a property before concluding a deal or beginning a real estate project. The goal is to gain a thorough awareness of the asset's state, any difficulties that might arise, and any underlying problems that might have an impact on its use or value. Investors can protect themselves from potential liabilities that may develop after the transaction, negotiate better terms, and make well-informed decisions by performing due diligence.

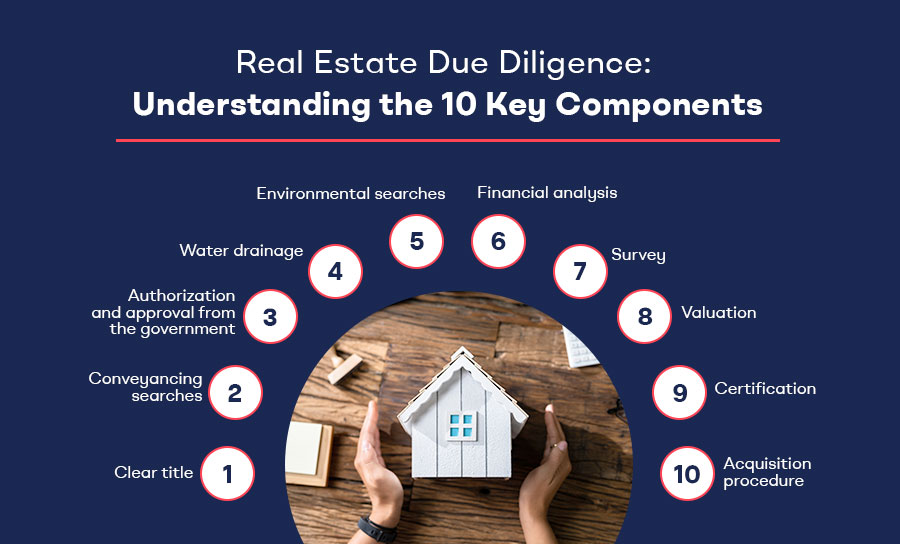

Examining the asset's legal status and ownership background is one of the key elements of due diligence. This entails carefully reviewing title records, deeds, liens, encumbrances, and other legal arrangements that can have an impact on the ownership rights of the asset. Following are the key components of due diligence:

In the United Kingdom, a clear title refers to a property that has no pending legal claims or disputes about ownership. It indicates there are no encumbrances, liens, or other legal difficulties that could impair the transfer or use of the asset. A clear title assures the customer that they are purchasing a asset with no hidden ownership issues.

Conveyancing searches are an important aspect of the UK due diligence process. They entail the buyer's solicitor or conveyancer doing numerous searches to acquire information about the property and its surroundings. Before the acquisition is finalised, these searches assist in identifying potential concerns or obligations linked to the property. The following are three types of Conveyancing Searches:

The Local Authority Search is an important search that offers information about the property's immediate surroundings. It is carried out through the local council or authority and comprises a number of features, including:

This section discloses whether any planning approvals have been issued for the property or neighbouring locations. It assists the buyer in understanding any development plans that may have an influence on the property in the future.

This section of the search gives information on any building regulations, approvals, or certificates required for property alterations or extensions. It assures that any improvements made to the property are in accordance with building codes. If the property is in a conservation area, this search will emphasise any restrictions or requirements connected to preserving the area's character and historical value.

This section contains details about neighbourhood public roads and pathways, road plans, and whether or not any highway proposals will have an impact on the property.

Government authorizations and approvals are crucial components of due diligence in the UK. In order to ensure conformity with local laws and zoning regulations, it entails requesting the requisite licences, permissions, and consents from the appropriate authorities. Buyers and developers are required to carefully evaluate any existing permissions and determine whether any extra conditions apply to their intended use of the property or any alterations to it.

The local water company conducts the Water and Drainage Search, which provides crucial details about the property's water supply, drainage, and sewerage. This search includes the following:

It certifies the property's water supply source (e.g., mains, well) and whether the property is connected to a public or private water supply.

This section of the search determines if the property is connected to the public sewer system or has a private drainage system (a septic tank, for example). It also illustrates the location of public sewers and any concerns that may arise.

In some situations, the search may also reveal information regarding the area's water quality, ensuring that the water is safe to drink.

The process of conducting general due diligence must include environmental due diligence. To find any environmental risks and liabilities connected to a property, extensive investigations and assessments are required. In order to reduce environmental risks and make wise decisions about the purchase or development of the property, this process aids buyers, investors, and lenders in understanding the environmental condition of the property, evaluating any potential contamination, compliance with regulations, and potential cleanup costs.

Analysing a property's finances is essential to establishing its viability as an investment. This involves examining the property's income records, expenses, rental agreements, and present and possible future cash flow. If the property does not have a trading history, a qualified RICS valuer should be appointed to forecast income and expenditures.

To find any structural problems, upkeep requirements, or potential risks, a comprehensive physical investigation of the property is necessary. This includes building condition, safety compliance, and environmental assessments.

Analysing the local real estate market is essential for determining the worth of the property and its potential for growth. Market analysis entails looking at local comparable sales, vacancy rates, rental demand, and property trends.

When performing due diligence, it is essential to prioritise various certifications and documents that validate compliance, safety, and legality. These certifications play a crucial role in assessing the property's condition and its adherence to regulatory requirements. Some of the vital certifications include the Electrical Installation Condition Report (EICR), Gas Safety Certificate, Energy Performance Certificate (EPC), Portable Appliance Testing (PAT), HMO Licence (if applicable), Lawful Development Certificate, and planning consents for alterations or extensions. By meticulously examining and obtaining these certifications, investors can mitigate risks, ensure property safety, and make informed decisions that align with legal and safety standards during the due diligence process.

The purchase procedure is the key component of real estate due diligence from a UK perspective. It comprises a thorough investigation of the ownership records, financial statements, and physical characteristics of the property. As a result, this stage assists buyers in making informed decisions, renegotiating conditions, or cancelling the transaction. To reduce risks and guarantee a successful deal, an effective acquisition procedure is essential.

Conducting real estate due diligence is an essential step that should never be overlooked when buying real estate. Buyers and investors can protect their interests by thoroughly examining the market, physical, legal, financial, and environmental elements of a property. Every step in securing a smooth and lucrative real estate transaction, from carefully reviewing ownership paperwork and financial records to conducting environmental evaluations, is vital.