Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

Foreign investors wishing to invest in landholdings have long considered the United Kingdom to be a preferred location. Its stable economy, robust legal system, and open landholdings market make it a suitable option for investors seeking long-term returns and diversification. If you are thinking about investing in the UK as an overseas investor, it's critical to understand the primary factors that make it an appealing option for landholdings investment.

One of the key reasons why the UK is a popular choice for overseas investors is its robust landholdings business. Despite intermittent difficulties, the UK asset market has risen consistently over the years, providing opportunities for capital growth and rental income. Asset demand in major cities such as London, Manchester, and Edinburgh remain strong, attracting both local and foreign tenants.

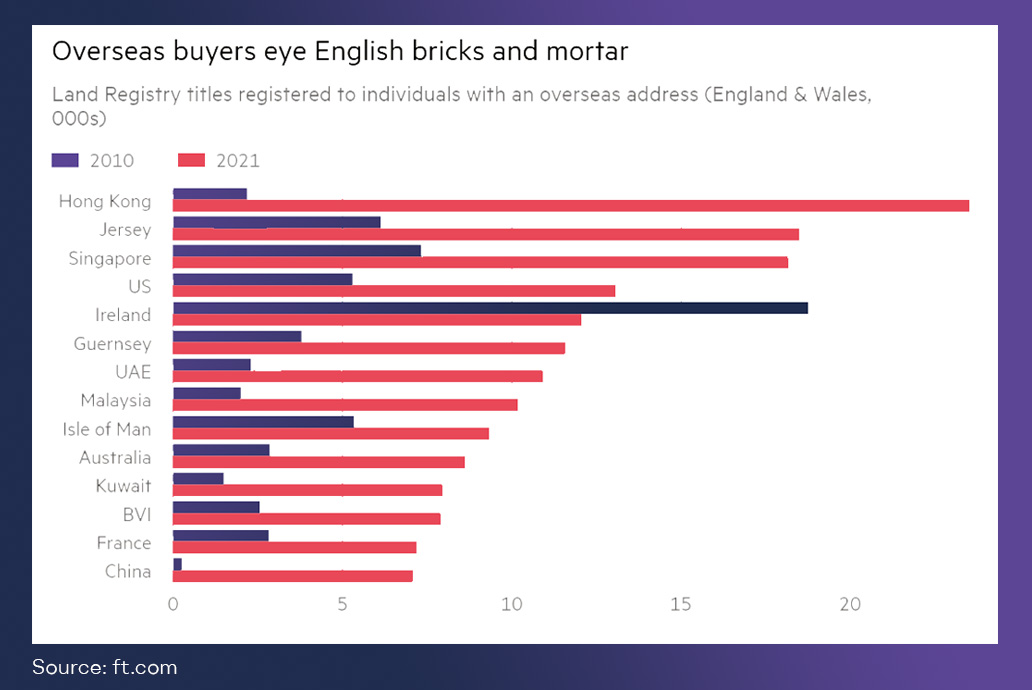

Let's look at some important statistics to further highlight the allure of investing in UK landholdings. Recent figures indicate that foreign buyers have a great interest in buying British landholdings.

The trends in foreign investment in the UK landholdings market is illustrated in the following graphs

Source: Financial Times

The graph below depicts the countries from which foreign investors have expressed a strong interest in purchasing asset in the United Kingdom. It emphasizes the diversity of foreign investors and their contributions to the industry's growth.

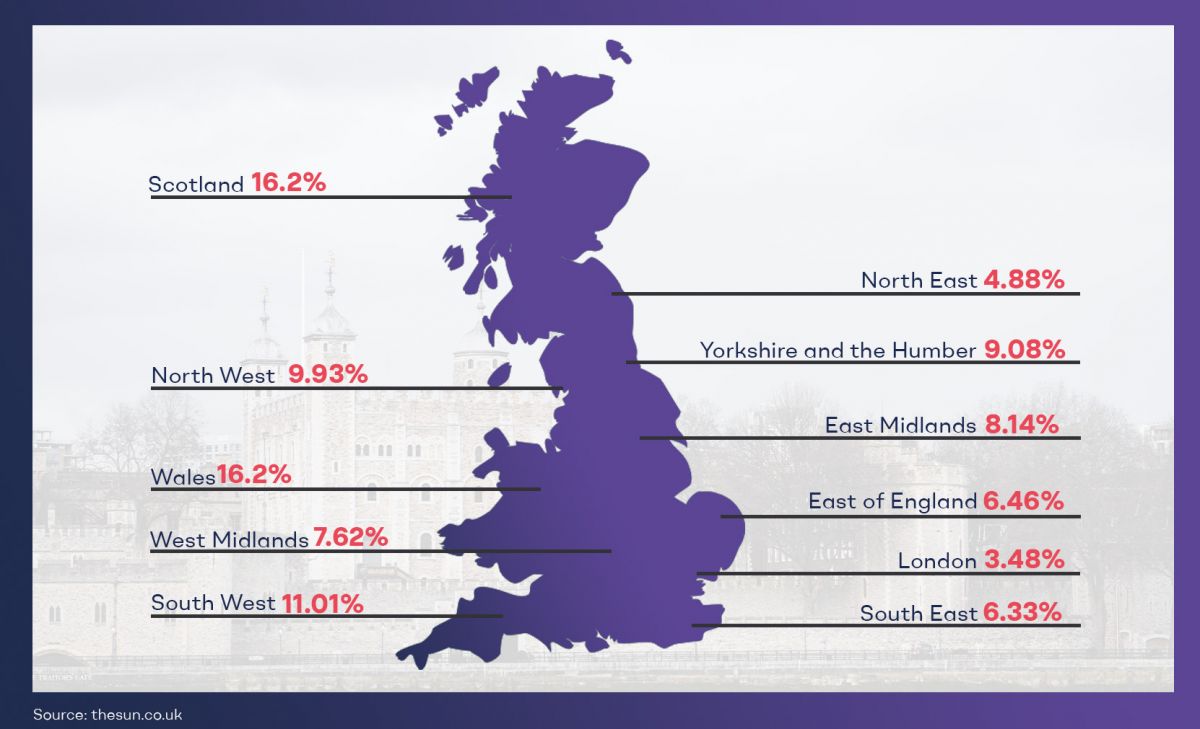

The average house price in the UK, broken down by city.

Source: The Sun

This graph illustrates the consistent rise in landholdings costs in significant UK cities, highlighting the potential for capital growth over time. It emphasizes how stable and alluring the UK landholdings market is to foreign investors over the long term.

Asking the correct questions from your agent or advisor is essential if you are an international investor thinking about buying landholdings in the UK. We have mentioned a list of questions that you must ask your agent if you are planning to buy asset in the United Kingdom. Our questions only give the reader a general idea of what information they should have before they invest in UK real estate. You may have other questions on the list to consider.

When investing in UK real estate, an overseas buyer must ask their agent certain questions. Some of the questions to consider are:

It's critical to comprehend the driving force behind the sale because it can shed light on the asset's condition, any problems, and any sense of urgency surrounding the deal. Understanding the seller's motivation will help you assess the seller's viewpoint and make wise selections. Finding out how long a asset has been for sale will give you a good idea of how desirable it is. An extended period of time spent on the market may indicate underlying issues or present a chance for negotiation.

Could the agent provide an explanation of the Energy Performance Certificate (EPC)? This is required by UK housing legislation and contains data on the asset's energy efficiency and environmental impact.

What is the normal energy bill costs that potential purchasers should take into account in their UK housing budget as well as the current council tax rate for the asset? Understanding these expenses enables purchasers to assess the total affordability and cost implications of owning the property.

Also, can you include details on the water pressure in the house, as it may have an impact on UK purchasers' comfort and daily living experience? In the UK housing market, adequate water pressure is a key consideration for purchasers.

Finding out whether the property's worth has changed recently will help you assess the state of the market. It enables you to determine the property's potential for future growth by revealing whether the value has increased or decreased. Knowing how frequently the property has changed hands in the past can bring up crucial issues. If a property has had several owners in a short period of time, this could be a sign of underlying problems, unsolved conflicts, or a history of problems that you should look into. Knowing the lowest price the seller would take is essential to structuring your offer correctly. With the help of this knowledge, you may negotiate effectively by matching the seller's expectations with your budget. It can be useful to be aware of any prior offers that have been made on the property as well as their results. It provides insight into how much the property is viewed as worthy, which you can use to create your own offer approach.

It's important to comprehend the tenure of the property, including its freehold, leasehold, or any other special ownership arrangements. It aids in your assessment of the property's long-term prospects, related rights and obligations, and potential restrictions. Has the house had any significant renovations or improvements that would affect its worth in the UK housing market? To ensure a smooth purchase in the UK real estate market, it is advised to inquire about any applicable indemnity insurance, which guards against potential legal complications relating to previous renovations.

Also ask how old the property is, and does this matter in the UK housing market? The age of a home can affect its architectural style, historical attractiveness, and maintenance needs, all of which are factors in the UK real estate market.

Learning about the neighborhood's amenities, schools, transportation alternatives, and community features can help you decide whether the property will fit your needs. It offers a wider perspective for assessing the location and appeal of the property. It is crucial to learn about any local plans or developments that might have an effect on the property. It enables you to foresee neighbourhood changes that could have an impact on the property's worth, livability, or the possibility of future sales, such as impending infrastructure projects or zoning changes. Also analyze if there are any difficulties with loud neighbours or disturbances in the neighbourhood that could lower the value of the property? As part of UK housing legislation, sellers must furnish the TA6 form, which contains information about the property, as part of the sale.

According to UK real estate regulations, what fixtures or furnishings are included in the sale of the property? To ensure openness in the sale, estate agents in the UK are required to give you information about the goods included or excluded in the sale. What direction does the house face, how does it affect the natural light that it receives, and whether or not it would be sought after on the UK housing market? For buyers in the UK, property orientation is crucial since it impacts the overall appeal and market value of the property.

Are there any unique covenants or restrictions affecting the property's worth in the UK real estate market? Is it listed? Is it situated in a conservation area? It is important for buyers to comprehend these legal classifications as they might affect property changes, renovations, and investment potential.

In the UK real estate market, purchasers place a high value on reliable connections. How strong are the broadband connection and the cell signal inside the property? Take note that the quality and accessibility of local cell network coverage and internet service providers can have an impact on a property's desirability.

Has the boiler in the house been the subject of any complaints or troubles, as this may have an impact on the buyer's comfort level and maintenance expenses in the UK housing market? For UK homebuyers, knowing the boiler's maintenance history is essential for determining its dependability and prospective costs.

How recently was the drainage and guttering system installed or maintained? As this is crucial for the property's effective operation and upkeep in the UK real estate and housing sectors. Have any of the rooms undergone recent redecoration, and if so, why? This data might shed light on the property's appearance, maintenance, and potential worth on the UK housing market. Would it be feasible to move the furniture or examine it more closely beneath the carpets to evaluate the flooring's condition and make sure it complies with UK real estate standards?

Is it feasible to speak with the sellers directly? This may give you firsthand information about the house, any potential offers, or other particulars that can affect your choice in the UK real estate market.

When working with real estate agents, purchasers must be cautious and alert to any potential fraud or dishonest tactics. Although many agents conduct themselves ethically and professionally, there may be times when people or organizations try to trick customers for their own gain. Before engaging in any agreements or transactions, it is advised for buyers to do extensive research, check the qualifications of brokers, and get recommendations or evaluations from reliable sources.

Novyy is a reputable company that provides a variety of services catered to international investors in the real estate industry. Novyy's fractional ownership solutions transform UK real estate investment. Novyy gives property investors unprecedented financial independence. Fractional property ownership lets investors diversify their portfolio, reduce risk, and enter the market with less capital. Novyy's methodology democratizes real estate investment, allowing more people to engage in the UK property market easily and flexibly.

One of Novyy's unique offerings, Foreign National Loans, helps international investors get finance for their real estate investments in the UK. This service is aware of the difficulties that international buyers encounter, such as credit history restrictions or variations in mortgage regulations, and it provides specialized financing solutions to satisfy their needs.

Foreign National Loans from Novyy provide affordable interest rates, adaptable terms, and individualized support from beginning to end. They are familiar with the challenges presented by cross-border transactions.