Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

As the UK property market gears up for 2024, investors are eyeing lucrative opportunities, with student accommodation investments taking the spotlight. According to Lender Together's predictions, there's a projected 50 percent surge in buy-to-let lending over the next five years, with student-let HMOs leading the charge. This trend isn't surprising considering the growing demand for housing in cities hosting universities. With record student numbers, the appeal of student accommodation investment becomes evident, offering higher yields and reduced vacancy risks. In this article, we'll delve into why student accommodation investment is gaining traction and explore its potential in the UK market for 2024.

In the UK, student property refers to accommodations specifically designed for students attending universities or colleges. This includes purpose-built student accommodation (PBSA), HMOs, and flats and apartments located near campuses. With high demand from students and stable rental income, investing in student property offers attractive returns, making it a promising investment option in 2024.

When considering student accommodation properties in the UK, there are several options to explore. These include:

Student Boarding Houses: These provide tenants, often university students, with rooms for short or extended stays, offering room and board facilities.

The average rent ranges from £290 to £400 per week.

Student Rental Shared Apartments: Ideal for new students, shared apartments offer affordable living arrangements where students can share communal spaces.

The average weekly rental cost of a shared room in purpose-built student housing is roughly £123.96.

Student Homestay Options: Homestays allow international students to live with local host families, providing an immersive cultural experience.

The average rent for foreign students is around £77 per night, although finding such accommodation can be challenging without local recommendations.

Purpose-built Student Accommodations (PBSAs): PBSAs are increasingly popular among students for their student-specific designs and amenities. They offer various options, such as en-suite rooms, studios, and shared apartments.

The average rent starts at £99 per week.

Houses in Multiple Occupation (HMOs): HMOs are another significant aspect of student accommodation in the UK. These properties house at least three tenants, forming more than one household, sharing facilities like bathrooms and kitchens. Particularly favoured by students, HMOs offer a sense of independence and communal living, often at more affordable rates. Investors eyeing student accommodation investments should consider including HMO properties in their portfolios owing to their popularity and potential for rental income.

Understanding these types of student accommodation properties can help investors assess student accommodation investment opportunities in the UK.

The demand for student housing in the UK continues to be robust, driven by various factors:

Moreover, there has been a shift from higher to medium and lower tariff universities because of falling A-level grades and tighter entry requirements. We expect this trend to drive additional demand for PBSA beds in areas where these universities are located.

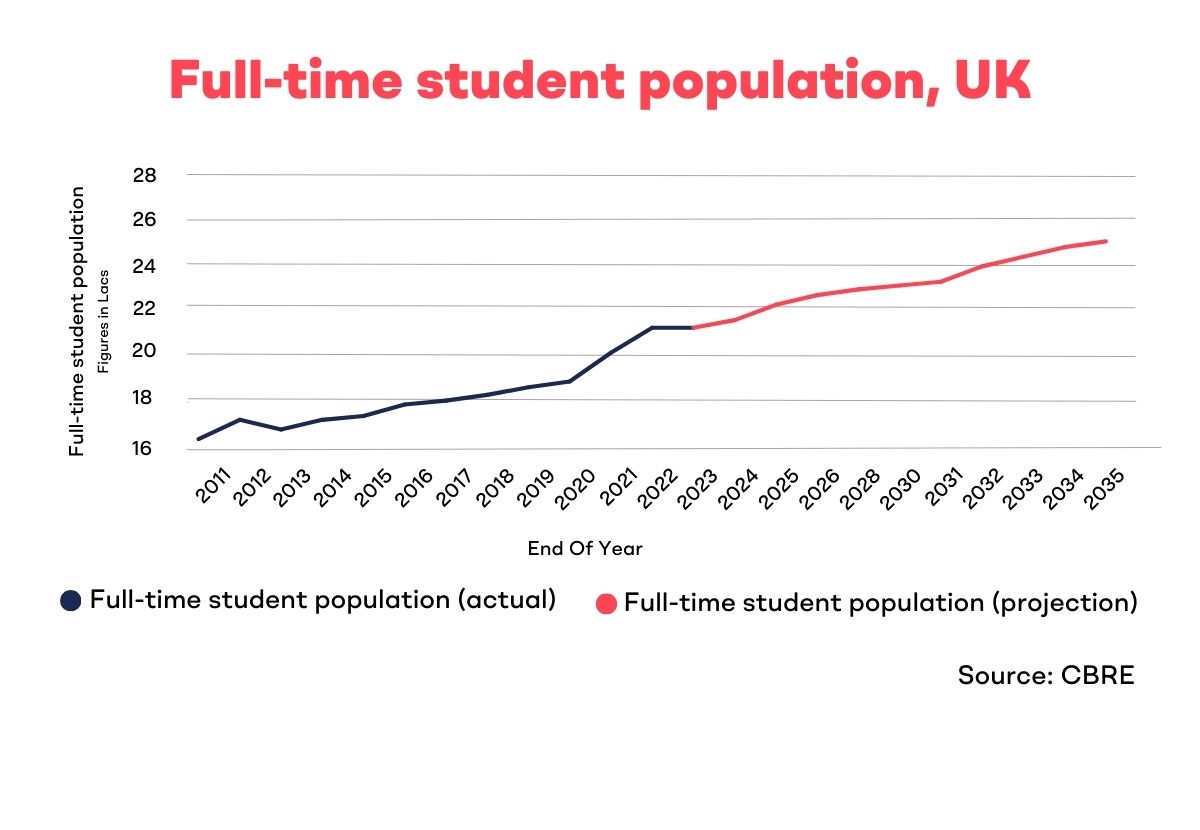

Here’s a visualisation of the full-time student population in the UK and projections for future demand:

The Higher Education Policy Institute projects that in order to meet demand, an additional 358,000 university places will be required by 2035.

The Higher Education Policy Institute projects that in order to meet demand, an additional 358,000 university places will be required by 2035.

The UK continues to need adequate accommodation solutions due to the strong demand for student housing and the projected increase in university participation rates.

Investment in student properties in the UK continues to be an attractive investment strategy in 2024, driven by ongoing trends and market dynamics.

Supply Shortfall: Since 2019, the growth rate of student accomodations has decreased significantly, with an annual increase dropping from 36,000 in 2019 to just 12,000 in 2023. As a result, there is a huge shortfall predicted around 490,000 beds by 2026.

Rising Rents: Student rents have been on the rise, increasing by more than 10% year on year against a backdrop of 6.7% inflation during the 2023–24 academic year.

Ownership Landscape: Private operators oversee nearly 80% of all student beds, with universities and private providers also contributing to the supply.

Bullish Market Fundamentals: Despite challenges, the fundamentals of supply and demand for operators remain strong, driving unprecedented rent growth. Early signs indicate significant increases in rent expected in 2024–2025.

Attractiveness: Investment in UK student properties remains attractive in 2024, supported by robust market demand and favourable investment conditions.

Despite challenges like stringent planning requirements and the need for modernization, investment in student properties in the UK will remain attractive in 2024, supported by strong market demand and favourable investment conditions.

Market size (2024): USD 8.52 billion

Market size (2029): USD 11.11 billion

CAGR (2024–2029): 5.45%

Key Insights:

Overall, the UK student accommodation market demonstrates stability and potential growth, driven by sustained demand from domestic and international students, alongside continued investment in educational infrastructure.

Before diving into student accommodation investments in the UK, it's crucial to thoroughly evaluate several key aspects to maximise your chances of success in this dynamic market.

By carefully considering these factors, prospective investors can make informed decisions and capitalise on the opportunities presented by the thriving student accommodation market in the UK.

Investing in student accommodation properties in the UK offers promising returns in 2024, driven by strong demand and favourable market conditions. To succeed, investors must focus on prime location selection, investment protection strategies, and offering enhanced amenities. Effective management, including regular maintenance and proactive security measures, is essential for maximising returns. Leveraging property management services like Novyy streamlines operations and ensures efficient management of student accommodation portfolios, providing investors with a strategic advantage in the competitive market landscape.