Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

Few products have sparked as much interest in the world of financial strategies as interest-only loans. Interest-only loans, which are generally viewed as a road to financial success, have drawn the curiosity of both investors and ordinary people. Let's explore what interest-only loans are and what their advantages are, whether you're a seasoned investor looking for fresh development opportunities or a genuinely curious person keen to comprehend how this financial tool functions.

For a predetermined amount of time, the borrower is required to pay only the interest on the principal amount borrowed. The borrower's monthly payments during this period only cover the interest that has accumulated; nothing is used to amortise the principal balance of the loan.

The loan is expected to be paid off either via a capital event or refinancing before the end of the tenure.

In real estate financing, interest-only loans are most frequently employed, primarily because they largely enhance the return on equity for investors. They provide borrowers with a number of possible advantages, including:

Investors can deduct the interest payments from their income, thus reducing their taxable income and thereby reducing their income tax burden.

Borrowers who choose interest-only mortgages have the distinct advantage of lower monthly payments while the loan is interest-only. The return on equity is directly proportionate to the cash flow from rents and therefore, the lower monthly payment results in a higher cash in hand thereby enhancing return on equity. Renting out a property can result in a reliable stream of rental income for the owner because the rent payments can cover the loan's interest payment, leaving the investor with a positive cash flow.

Interest-only loans give borrowers more financial freedom, enabling them to better control their expenses and cash flow. For people whose income is erratic or who anticipate future increases in income, this flexibility is very advantageous.

Borrowers with interest-only loans benefit from paying only the interest on their loan which is beneficial during low-income or financially uncertain periods, easing their monthly financial burden. They are able to save money this way and keep a safety net for when things get tough.

In the early years of homeownership, interest-only mortgages gave borrowers a unique way to handle their mortgage payments, giving them more financial flexibility. In this mortgage arrangement, borrowers have the choice to make initial payments for an initial term, often lasting five years or more, only to cover the interest that has accrued. The monthly payments during this interest-only term are consequently far lower than those of conventional mortgages, improving homeowners' cash flow.

To better comprehend the structure of interest-only mortgages, let's look at an example:

Imagine that smart investor Alex takes out an interest-only loan with a 7/1 structure to buy a £400,000 house. This mortgage has a 6% interest rate. In this case, Alex would choose the seven-year interest-only period. Let us assume that Alex borrows £300,000 for this property.

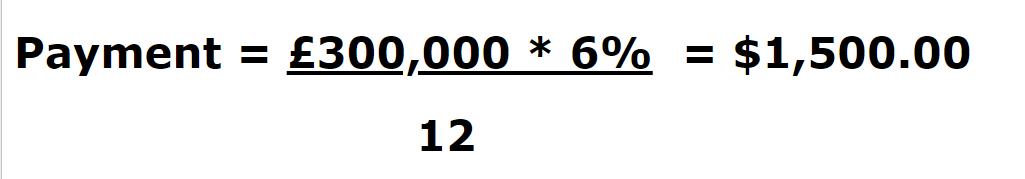

The only factor used to calculate Alex's monthly mortgage payment is the interest that has been accumulated on the £300,000 principal. The monthly interest payment can be computed using the following formula:

Calculate your monthly mortgage payment here.

Compared to a conventional mortgage that includes both principal and interest payments, Alex's initial monthly payment under the interest-only mortgage would be £1500. This would significantly reduce Alex's cash flow burden.

It's important to understand that the loan will have to be settled either via refinancing or exiting the property at the end of the 7 year period. If refinanced, Alex's monthly payments depend on the new interest rate that the new structure establishes for the new loan term. The monthly payments may rise or fall depending on the then prevalent interest rate.

Alex's may be able to refinance on better terms and perhaps release equity at the end of the 7-year period assuming that the property would have increased in value by then. Alex went for a 75% LTV and if the property went from being worth £400,000 now to being £600,000 in 7 years, Alex will be able to refinance £450,000 in his new loan which would mean he would get back all of his equity plus another £50,000 in profit and still continue to own the property.

People should carefully evaluate their financial condition, future earning potential, and risk tolerance before choosing an interest-only mortgage. Finding the finest interest-only lender and comprehending the long-term effects of this particular mortgage arrangement require working with a professional broker.

For sophisticated borrowers who fully understand how they work and can manage the possible hazards involved, interest-only mortgages may be a good option. To make well-informed decisions that are in line with one's financial goals, as with every financial decision, rigorous research and expert counsel are essential.