Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

The Indian government collects taxes at the source of payments using a system known as Tax Collection at Source, or TCS. This collection mechanism helps the Tax Department collect tax revenue upfront rather than wait for the taxpayer to self-assess their tax dues at the end of the year. Such levieses are usually refundable / adjustable with the overall levies bill of the taxpayer. Because of recent modifications, Tax Collected at Source is now applicable to a wider range of transactions, including international transfers made through the Liberalised Remittance Scheme (LRS) of the Reserve Bank of India (RBI) which allows Indian Nationals to remit upto $250,000 overseas every fiscal year for expenses such as family maintenance, education, tourism, investments, etc. without seeking an approval from RBI under the Foreign Exchange Management Act (FEMA).

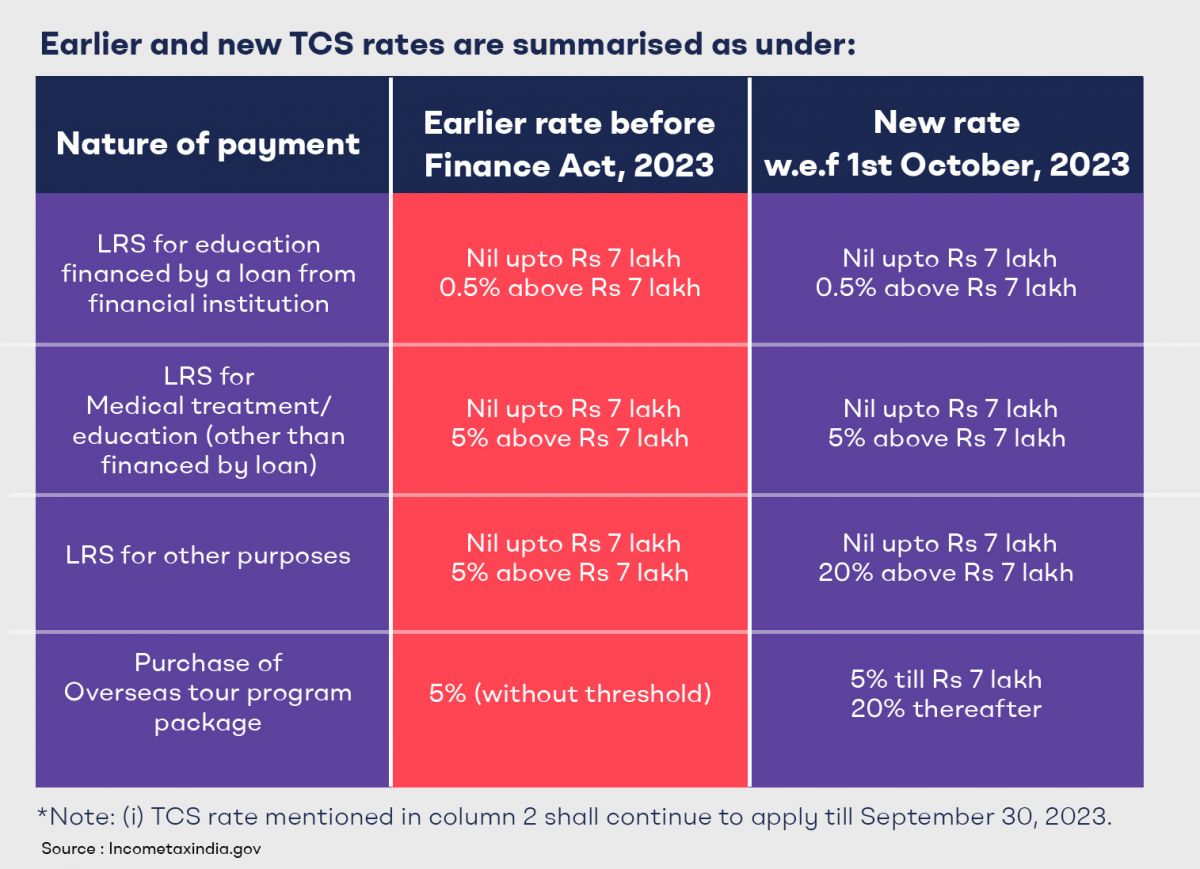

Recently, The Finance Act, 2023, changed sub-section (1G) of section 206C of the Income-tax Act of 1961. This will include a threshold of Rs. 7 lakh each financial year per person for all types of payments, independent of the purpose:

There will be no Tax Collected at Source on the first Rs 7 lakh remitted under LRS. Beyond the first Rs. 7 lakh per annum, Tax Collected at Source will be effective at the rate of 0.5% (if remittance for education is financed by a loan received from a financial institution), 5.0% (if remittance for education or medical treatment), and 20% for all other remittances.

Tax Collected at Source will continue to apply at the rate of 5% for the first Rs 7 lakh per individual per year when purchasing an international trip programme package under clause (ii) of sub-section (1G) of section 206C.

Below is a glimpse of the difference between the earlier and new Tax Collected at Source rates.

Let us examine how the new Tax Collected at Source rates will affect the Indian backers investing abroad.

The modified Tax Collected at Source regulations' most noticeable effect is the levy rate's sharp increase. For remittances sent under LRS, including costs associated with international travel packages, the levy has increased from 5% to 20%. This higher rate may significantly reduce investors' disposable cash, particularly if they frequently send money overseas or travel abroad. According to Section 206C of the Income-tax Act of 1961, several changes were made.

Tax Collected at Source refers to the upfront collection of a portion of the investment as levy at the time of remittance, which lowers the liquidity available for investment. Investment tactics and cash flow management may be impacted by these instant levieses.

The Rs 7 lakh threshold for activating Tax Collected at Source on LRS has a direct impact on backers. Where backers already have foreign exchange commitments for education or tourism, and such commitments cross the threshold, foreign investments will not be able to use the threshold and will be subject to the 20% tariff rate.

For Indian backers, the imposition of a 20% Tax Collected at Source on international investments, including foreign equities, mutual funds, cryptocurrencies, and property, has resulted in a large initial cost increase for these types of investments. However, Tax Collected at Source paid can be adjusted with the annual tax obligation or claimed as a refund.

The higher Tax Collected at Source rate may discourage some backers from diversifying their portfolios into foreign assets, notwithstanding the benefits of diversification that come from international investments. This might make it harder for backers to spread out their risk and perhaps take advantage of international investment opportunities.

TCS is adjustable / refundable under certain circumstances. backers can claim an adjustment or a refund at the time of filing their Income Tax Return (ITR).

An explanation of how the TCS has affected Indian backers' real estate investments abroad is provided below:

For Indian backers, the TCS will result in an increase in initial cost while purchasing foreign real estate. The additional 20% cash requirement may make it difficult for some backers to afford investing in overseas real estate. While TCS is adjustable / refundable with the annual tariff liability of the tariffpayer, the imposition of TCS results in higher cash requirement at the instance of remittance.

As a result of the 20% TCS imposition, some backers may revise their budget downwards by 20%+ to accommodate for the excess cash required in this instance. For example, an investor who earlier had a budget of £100,000 may now revise it to £75,000 to £80,000 to keep cash flow constant.

Real estate investors can take advantage through the following:

Real estate investors must conduct a thorough investigation into and understanding of the new TCS regulations. Knowing the exact guidelines and deadlines related to the TCS deployment is part of this. Accountants can advise on an investor’s annual tariff obligations and timelines for getting refunds from the government which can help investors make an informed decision.

Investors need to start planning for the TCS as soon as possible. This entails including the 20% tariff in the sum of the initial costs associated with purchasing international property. Albeit adjustable / refundable, this cost being at the point of remittance makes it an important consideration for the overall outflow.

Investing in nations with whom India has a DTAA can be a wise strategic choice. While this has no impact on the TCS obligation, subsequent tariffes on incomes and capital gains from the investment can be shielded where DTAA agreements exist such as India-UK which include provisions to prevent double tariffsation.

Investors need to be aware that they could be able to request an adjustment or a refund of the TCS amount at the time of submitting their annual tax returns. By submitting an income tax return with the Indian government, they can seek an adjustment or a refund if their yearly tariff obligation is lower than the TCS amount.

Indian investors have access to real estate investment opportunities through companies like Novyy Technologies. It is a UK-based real estate investment platform specializing in fractional ownership and student housing. Novyy also provides a financing option that can assist investors in better managing their tariff obligations and costs. An explanation of how this financing option can alleviate the TCS pain is provided below:

Tax-Smart Investment: By offering a tax-smart approach to investing in foreign real estate, Novyy's financing solution reduces / postpones the cash flow requirement under new TCS laws. Investors have the option to choose a financing plan that enables them to spread their investment over a longer term, often 5-7 years, rather than making a huge upfront purchase for a home, which would result in a sizable TCS payment. For example, instead of putting up £500,000 for a property in one go which will require a TCS payment of £100,000 additionally, Indian Investors can use Novyy’s financing option which can provide upto 75% of the purchase price for a fixed interest rate for 5 and 7 years. This reduces the investor’s initial cost by 75% and such investors can continue to remit 10-15% every fiscal year until the financing is closed.

Reduced TCS Obligation: By dividing up the investment across a number of years, the TCS obligation is also divided, greatly lowering the investor's immediate tariff burden and freeing up cash flow. This strategy enables investors to keep a larger amount of their capital up front, which they can use for additional investment possibilities or to better manage their financial obligations.

For Indian investors, the financial environment has changed as a result of the imposition of the 20% Tax Collected at Source (TCS) on foreign investments and remittances. Several asset classes, including foreign stocks, real estate, and more, have experienced significant effects as a result of this transition. In order to maximise their assets, Indian investors must navigate these new tariff restrictions by staying educated, making strategic plans, and looking into tariff-efficient options.

TCS has a significant effect on international property purchases for real estate investors, resulting in more costs and complexity. However, strategies like Novyy Technologies' financing option provide a tariff-smart strategy, enabling investors to better manage costs and TCS obligations. Investors can lessen the immediate financial load and keep better control over their cash flow by spreading out investments over a number of years.

In the end, Indian investors who want to maintain and increase their wealth in a more globalised investment market must adjust to the changing tariff landscape. To successfully handle the effects of TCS on foreign investments, it's imperative to stay informed, take tariff-efficient tactics into account, and investigate investment partnerships that comply with the new legislation.