Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

Exploring the UK's property investment landscape reveals a terrain ripe with opportunities for consistent rental returns and long-term financial stability. Amidst the dynamic UK property market, the allure of residential rentals stands out prominently. With a keen eye on the evolving preferences and needs of tenants, investors are turning towards lucrative sectors such as student housing, HMOs (Houses in Multiple Occupation) , and co-living spaces . This strategic shift mirrors the growing demand for diverse, flexible, and community-oriented living arrangements, propelling the UK rental sector into the spotlight of property investment ventures. In this comprehensive guide, we navigate the intricacies of investing in UK rental properties, exploring the benefits of buy-to-let strategies, the potential of student housing and HMOs, and the allure of co-living spaces. Join us as we unravel the secrets to securing consistent rental returns and unlocking the full potential of the UK's residential rental market.

In the realm of property investment, one perennial debate revolves around the comparison of rental yields between London and non-London regions. This discussion holds significant weight for buy-to-let investors seeking optimal returns in the UK rental property market, particularly within sectors like HMOs and student housing buy-to-let.

London's rental landscape paints a picture of contrast. While some areas in east and south-east London boast impressive average gross yields, hovering around 5.7%, the story in Westminster, Kensington or the city of London unfolds differently. Here, the rental yield dips, possibly because of the borough's status as one of London's priciest locales. London's property investment scene reflects the balance between high demand and hefty investment costs.

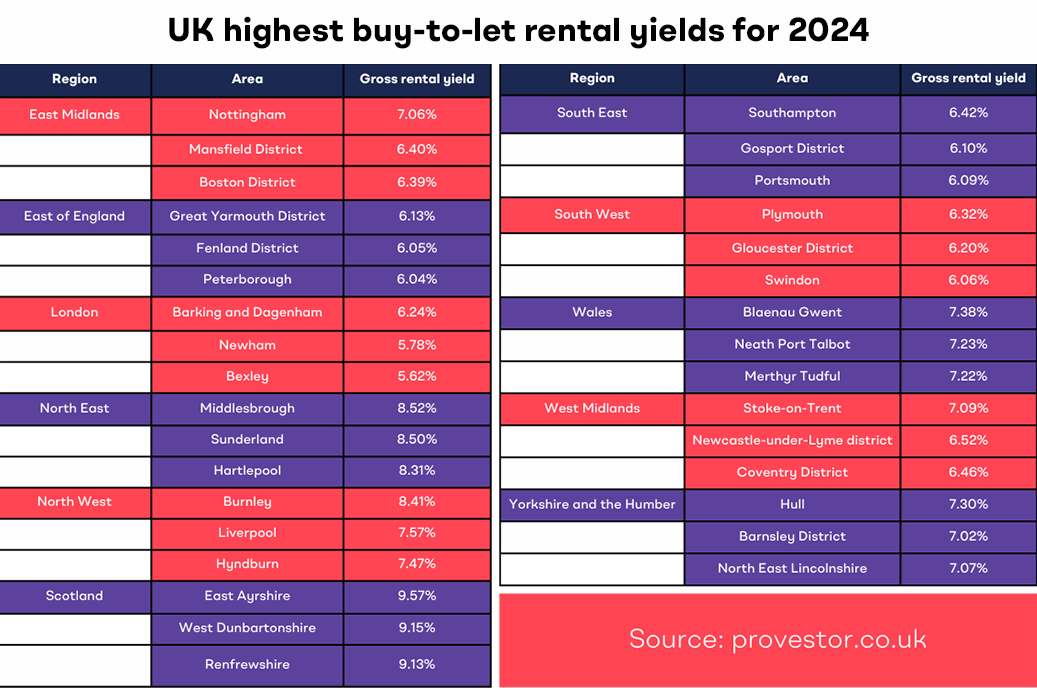

On the flip side, non-London regions offer their own compelling narratives. According to data from Zoopla, areas like Nottingham in the East Midlands flaunt gross rental yields exceeding 7%, demonstrating the allure of property investment beyond the capital. Similarly, cities like Birmingham, Manchester, and emerging hotspots like Derby and Coventry showcase promising prospects for rental yields and overall property investment growth.

Below is a table showcasing rental yields for different regions in the UK for 2024.

Investors determine between London and non-London investments based on various factors. For buy-to-let enthusiasts, evaluating rental yield trends, growth potential, and economic fundamentals becomes paramount. While London may offer prestige and demand, non-London regions present opportunities for higher rental yields and potentially lower entry barriers because of lower price point, particularly in burgeoning sectors like student housing and HMOs in uni-towns

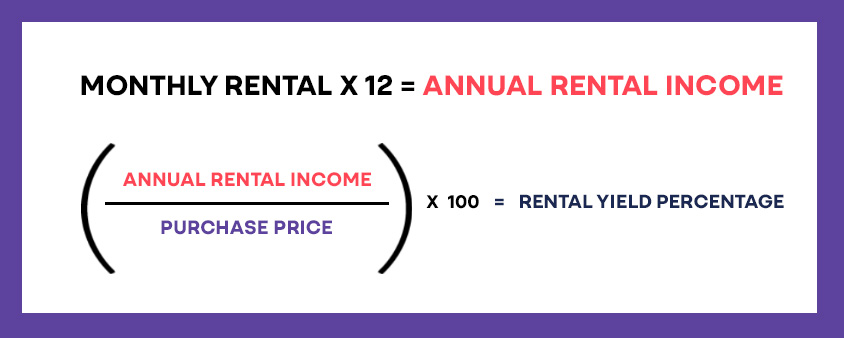

For buy-to-let investors navigating the UK property investment landscape, understanding rental yield is paramount. Rental yield denotes the potential returns on property investment through rent, providing crucial insights for informed decision-making.

A simplified approach to calculating rental yield is essential. Whether it's a buy-to-let, HMO, or student housing, grasping rental yield ensures sound investment choices and the affordability of buy-to-let mortgages.

Maximising rental income entails considering both gross and net rental yields. While gross rental yield provides a snapshot of potential returns before expenses, net rental yield factors in associated costs and fees, offering a comprehensive view.

To enhance rental yield, landlords can adjust rents to align with market rates, explore HMO opportunities to accommodate more tenants, and optimise outgoings by seeking cost-effective maintenance solutions.

Capital growth complements rental income, representing the property's value appreciation over time. While property prices fluctuate, strategic property investments, coupled with prudent management, can yield favourable rental income and capital growth.

In essence, mastering rental yield calculation and maximising rental income empowers property investors to navigate the dynamic UK property market efficiently, ensuring sustainable returns on their property investments. One can calculate annual rental income and rental yield percentage using the following formula:

The UK's stringent regulatory framework provides a solid foundation for property investment, offering transparency and legal certainty. Legislation such as the Economic Crime (Transparency and Enforcement) Act 2022 ensures accountability, particularly for overseas entities owning UK land.

Buy-to-let investors and those interested in rental properties benefit from the clear guidelines outlined in the Law of Property Act of 1925 and the Land Registration Act of 2002. These regulations, coupled with advancements in electronic conveyancing, streamline transactions and promote efficiency.

The Land Registry provides a state guarantee of title that instills trust in real estate transactions, offering protection against mistakes and ensuring ownership records' integrity.

HMO and student housing sectors benefit from regulatory oversight, ensuring adequate standards for accommodation and tenant welfare. With laws governing leases and environmental considerations, investors in these niches can navigate the market confidently.

The UK's commitment to upholding legal principles, coupled with advancements in electronic conveyancing and land registration, streamlines property transactions. Electronic document submission and access to the land register expedite processes, promoting efficiency and reducing investor administrative burdens.

The Land Registry's aim to achieve 100% registration by 2030, along with this guarantee, strengthens investor confidence in the market.

Transparency in Property Valuations: The Importance of Clear and Transparent Property Valuations in the UK

Clear and transparent property valuations are essential for navigating the UK property market, especially for investors in buy-to-let, student housing, and other rental properties. Accurate valuations enable sellers to set realistic prices and empower buyers to make informed offers.

Understanding valuation methods such as the comparable approach, income approach, and cost approach is critical for investors to effectively assess property value. Transparent valuation reports, such as market appraisals and homebuyer reports, provide reliable information, fostering trust in the transaction process.

Factors influencing property values, including location, market trends, and property condition, must be carefully considered. Regular valuation updates and a thorough understanding of valuation terminology enable individuals to negotiate effectively and avoid overpaying or under-pricing their properties.

Thus, transparent property valuations are vital for fostering trust and confidence in the UK property market. By prioritising accurate valuations and understanding valuation methods and factors, investors can make sound investment decisions, leading to successful outcomes in their real estate ventures.

Investing in UK property offers lucrative opportunities, but understanding its legal and financial landscape is crucial. At Novyy, we empower investors with key insights to navigate these complexities effectively.

Rental income is subject to income tax, assuming there are allowable deductions.

Capital Gains Tax: This tax affects sale proceeds and is influenced by ownership duration and structure.

Stamp Duty Land Tax (SDLT): This is paid on property purchase; the rate varies depending on the property's price.

Inheritance Tax: Estate value determines potential tax liabilities upon the owner's demise.

Investors can explore mortgage, equity, or crowdfunding avenues for funding.

Each option presents unique advantages and risks, demanding careful evaluation aligned with investment goals.

Adhering to planning permissions, building regulations, and health and safety standards is paramount.

Understanding tenancy agreements, licencing obligations (e.g., HMOs), and consumer protection laws ensures legal compliance and operational efficiency.

Efficient management involves handling contracts, insurance, maintenance, rent collection, and tenant relations.

While self-management is an option, outsourcing to professional property management services can streamline operations and mitigate risks.

The UK's housing market has seen robust growth, with prices surging by 8.8% in the 12 months to June 2023. However, this growth pales in comparison to other Anglosphere countries.

Across the Anglosphere, house prices have skyrocketed. In the US, prices soared by 16.6% in the year, according to the S&P National Home Price Index. Untill June 2023, Canada witnessed a staggering 17.9% increase in average house prices. Meanwhile, Australia experienced a similar surge, with median house prices climbing by 19.0% in the year to July 2023. New Zealand outpaced them all with a remarkable 25.2% increase in prices during the same period.

While the UK's housing market growth is noteworthy, it falls short of the rapid expansion seen in other Anglosphere nations. To look at it critically the transparency of valuations make it a more dependable market and controlled supply ensures a health re-sale value which works in favor of the investors. Several middle eastern markets have also seen massive jump in prices but with little or no movement in existing stock; in such markets only new stock continues to sell at higher prices but old stock finds no buyers in the same area.

As we conclude our UK property investing series, investors seeking stable rental income and long-term financial stability have many options. Buy-to-let, student housing, and HMO investors have several options in the UK property market, from London to the countryside.

This landscape requires legal, financial, and regulatory knowledge to comply and maximise results. A good investment strategy includes tax consequences, financing choices, regulatory compliance, and efficient property management.

Although the UK housing market is growing, international comparisons show global patterns and opportunities. The UK's growth lags behind that of other Anglosphere nations, showing that worldwide housing markets are dynamic despite their strength.

Investing in UK property can help you achieve financial success and market resilience. Investors may maximise the UK's rental property market's potential with careful research, strategic planning, and a sharp eye on trends, securing sustained returns and contributing to the property investment boom.The UK property investment market offers excellent profits for buy-to-let, HMO, and student housing investors.