Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

Many people consider homeownership as a major achievement that symbolises long-term financial security. As in many nations, the UK allows buyers to buy a home with cash or a mortgage. Cash purchases may seem like an easy way to become a homeowner, but there are several reasons to choose a mortgage. Using a loan to buy a UK house has tactical and financial advantages over cash payments. Regardless of your investing expertise, knowing these advantages can help you make an informed decision about one of your biggest investments.

So, below are some points that you must consider while purchasing a property in the UK, especially if you are a foreign investor.

Also read Why Interest Only Loans Become Wealth Creators.

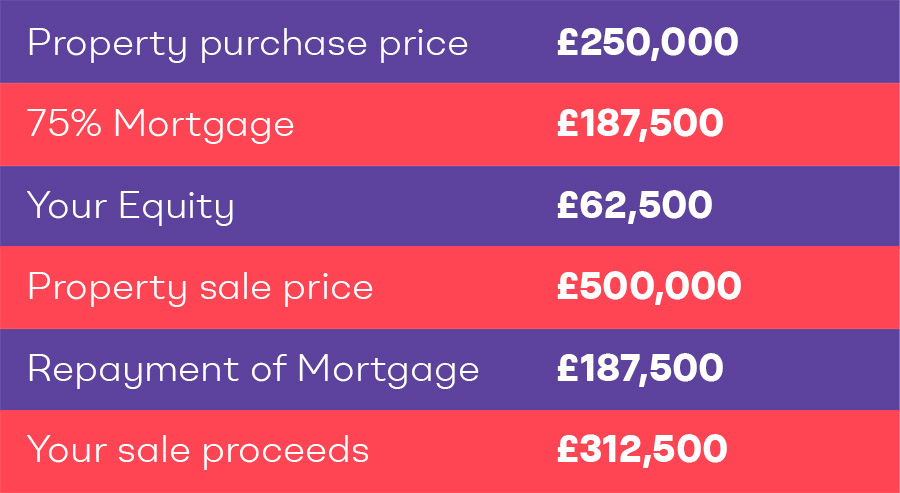

First and foremost, a loan, especially an interest only one, increases your return on equity / return on investment by many folds depending on the time horizon. For example, you buy a property worth £250,000 and sell it for £500,000 after 10 years.

In scenario 1, cash purchase, you make a 100% return on investment.

In scenario 2, where you have secured a 75% interest only loan, you make 500% return on investment. Here’s how –

As you can see above, you invested £62,500 and got back £312,500 which is a 5x return of investment.

Paying cash for a property may seem cheaper because there are no loan payments, but consider the bigger picture. Fundamentally, Debt is always cheaper than equity.

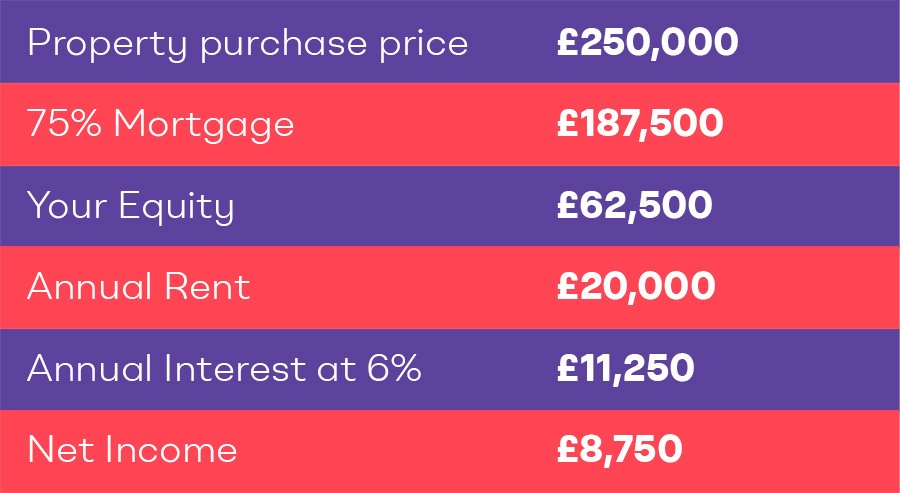

If you are buying a property worth £250,000 which generates an annual rent of £20,000, the gross yield on your capital is 8%. However, if you can finance 75% of your purchase price via a BTL loan at 6%, your capital yield will increase significantly. Here’s how –

An income of £8750 on an investment of £62,500 represents a capital yield of 14%.

The property's worth is a crucial consideration when purchasing a home, whether for financial purposes or personal use. The process of valuing the property is one interesting factor to consider when deciding between a cash payment and a loan.

If you choose to pay for a property with cash, you can come across sellers who are overly optimistic about their properties, which would result in a higher selling price. In these situations, the lack of a loan implies that the valuation procedure is conducted without the involvement of a third party, which could lead you to overpay.

In contrast, if you choose to take out a loan, lenders require the property to be valued using trustworthy sources like the VAS Panel. This panel is made up of a network of more than 200 independent valuers in the UK, ranging from large national companies to small local businesses.

The VAS Panel provides precise and current valuations, adding an additional degree of assurance. This implies that you are shielded from paying an exorbitant price for the house when you obtain a loan. You protect your investment and make wise financial decisions because your purchase is based on the property's genuine market worth.

Loans offer financial flexibility, which is a major benefit. Instead of locking a lot of money in your home, you can use it elsewhere. This flexibility is useful if you want to diversify your portfolio, pay unexpected obligations, or invest.

Invest the money you would have spent on a outright purchase by availing a loan. Long-term returns on stocks, bonds, and other assets may exceed loan interest and multiply wealth instead of locking it up in an asset

Tax benefits may result from itemising mortgage interest deductions. Tax deductions for mortgage interest can save a lot over time. By using these tax benefits, you may save more than if you had paid cash.

Mortgages can provide protection against certain creditors in certain situations. Homestead exemptions in some UK jurisdictions protect homeowners from having to sell their property to pay off debts. This insurance might provide financial protection in challenging times.

Investing the savings from a mortgage could lead to a bigger net worth than with a cash payment because of interest and closing costs. Long-term stock or real estate investments can beat mortgage interest rates.

Further Borrowing: Mortgages are a good way to borrow money while interest rates are low. Remortgaging to free up equity can be cheaper than taking out a personal loan or using credit cards for home improvements.

For British real estate investors, deciding whether to take out a mortgage or buy a home in cash is a crucial choice. Although each option has advantages, getting a mortgage is the wisest financial move.

With the financial freedom that mortgages provide, you can save money for unexpected expenses and take advantage of investment opportunities. They offer simplified home buying procedures, tax advantages, and debt protection. In addition, utilising a mortgage results in faster capital growth, permits larger rental income, and provides affordable additional borrowing.

The procedure of property valuation notably provides an extra degree of security. With a mortgage, organisations such as the VAS Panel are involved, ensuring that you pay a fair price for your home.

Disclaimer: This article provides only an overview of the advantages of using a mortgage over cash to purchase a home in the UK. It is essential to conduct due diligence and seek professional advice before making this significant financial decision, as individual circumstances and goals vary.